Vision 2040: Fishupdate.com reports that the seafood industry in England has launched a long-term strategy aimed at creating a thriving and sustainable industry through what is described as an ambitious new plan called Seafood 2040 (SF2040).

Seafood 2040 brought together stakeholders from across the seafood supply chain in pursuit of a single common goal to produce a vision for the industry over the next twenty years. The resulting document (available on the Seafish website) begins by detailing the vision in six different areas.

The first is that by 2040, seafood consumption should have almost doubled to reach recommended levels of at least two portions (one of which is oil-rich fish), per person, per week, fuelling economic growth within the sector and returning substantial health gains and associated cost savings for the UK. The remaining five areas cover the supply chain.

Given that increased seafood consumption appears to be the cornerstone of this strategy, we, at Callander McDowell, were surprised to see that this strategic priority only appears in Section 3 (page 26 of 60) of the report.

The Government’s target for consumption is two portions of fish a week, one of which is an oil rich fish, however the average person is managing to eat just 1.15 portions per week and only one portion of oily fish every three weeks. Seafood 2040 hope to nearly double consumption so that the public consume the recommended two portions of fish each week. By increasing the amount of fish eaten, consumers will be eating a healthier diet and helping realise significant health cost savings as well as increasing UK fish and seafood sales by over £4.5 billion.

For a long time, we, at Callander McDowell, have been a lone voice about the shortfall in fish consumption so we welcome wider recognition that action must be taken. At the same time, we just don’t think that this objective will be realised. We don’t want to appear negative, but It is going to take something more than the promotion of the health benefits of fish and seafood to persuade the British public to increase the consumption of these foods. The fact is that many consumers, especially those that need to be targeted, are simply not interested in associating fish with healthy eating. Fish might be beneficial for human health, but the public do not choose the foods they eat because they are beneficial for their health. Most eat because they enjoy the foods they eat. This is why obesity has become so much of a problem. Even if individuals recognise that they need to do something about piling on the pounds, it is unlikely that they will turn to fish for a solution because eating fish comes with too many other obstacles that need to be overcome. Promoting fish as a healthy choice will largely fall on deaf ears and as a result the objectives of this strategy are unlikely to be met.

However, it is not just consumers who have been at fault. Over the last couple of decades, the fish and seafood industry has largely failed to get its message across. This is for two reasons. The first is that the industry attention about consumption has been deflected by the environmental groups and the issue of sustainability. Instead of talking about consumption, industry meetings now seem to be dominated by the question of sustainability. Of course, sustainability will become irrelevant if consumers never eat fish.

The second reason is that any industry promotions tend to be focussed on consumers who already eat fish. It is far easier to persuade a consumer who eats a portion of fish to eat another one than it is to persuade a consumer who never eats fish to start to do so. The average consumption is already over one portion a week which would give the impression that the challenge to increase consumption should be easier than it is. However, this average consumption is made up from fewer people who do eat in excess of two portions of fish a week and many more who never eat any. There are many families who are likely to have at least two generations who never touch fish and now never will, because they have lost the drive to even consider eating fish. Telling them that eating fish is beneficial for their health is akin to pouring water onto a duck’s back. Something else is required if we are to see a radical sea change in fish and seafood consumption.

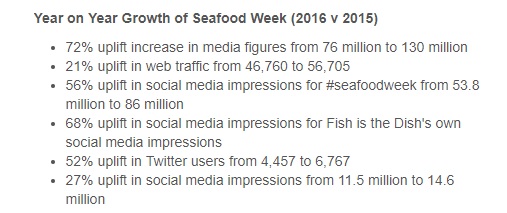

Seafood 2040 also considers the way that the healthy eating can be conveyed to consumers. The strategy states that the power of the collective action in the promotion of seafood has been well-evidenced through the ‘Seafood Week’ and other generic campaigns.

Seafood Week has now run for three years since it was reintroduced after a few years gap. Before that it had been an annual event for six or seven years but was dropped, presumably because it wasn’t achieving its aims. The new format was launched three years ago and was described as ‘an annual campaign aimed at getting more people to eat more fish.’ We have previously discussed the results of these campaigns, but the attached table shows the claimed year on year growth between the 2015 campaign and that of the following year. The figures look impressive but for us, at Callander McDowell, there is one thing missing – any reference to changes in consumption. This might have been an effective media campaign, but did it result in any increase in consumption? None is mentioned.

Finally, the strategy mentions briefly development of markets for underutilised fish species. Over the years, there have been several attempts to persuade consumers to move away from the Big Five species, representing 80% of fish consumption. This is very much a side issue since if consumers are not eating any fish, then there is very little point telling them that they should be eating a different species. Some years ago, the UK Government spent over £300k to investigate the use of underutilised fish and the best suggestion was their use as pot bait. It doesn’t require £300k to see that one of the simplest solutions is that the Government should buy up these lesser consumed species and to work with high-profile chefs to produce tasty and attractive dishes that can be served in Government institutions and departments. The army, prisons, schools, hospitals and even Westminster should be using these species. After all, the industry tells us that they are just as, if not more tasty, than the Big Five.

By coincidence, Intrafish reports that Sainsbury’s efforts to persuade consumers to eat beyond the Big Five are now paying off. The retailer hopes to reduce consumption of the leading species from a current 80% to 60% of their sales. They now report that sales of the Big Five now account for round 70% of their sales, a figure that surprised even the retailer itself. The campaign to eat a wider selection of fish began five years ago with their ‘Switch the Fish’ day. Even the retailer admits that this was not hugely successful which is why they are now surprised at how quickly consumers have embraced new options.

The retailer has the benefit of their sales data for each species and format, but our impression on first reading this news was that the main reason why the product mix had changed in recent times could be due to the price of salmon. Higher prices have reduced demand for salmon in most British retailers. This can be seen simply by the amount of fish being stocked on the shelves. Reduced demand for salmon will undoubtedly change the marketing mix of species giving the impression that there has been a shift from salmon to other species. In fact, it could be just a shift away from salmon.

Steady decline: Fishupdate.com reported at the end of last month that sales of fresh fish and seafood throughout Western Europe, including the UK are continuing to decline year on year. These are the findings of Euromonitor International, who found that sales fell by 1% to 5.8 million tonnes out of a total global consumption figure of 102 million tonnes. Their most significant finding is that the growing focus on general health and wellbeing and healthier diets in Western Europe has not translated into a greater demand for fish and seafood. They say that the primary barrier to a more dynamic consumption is a lack of cooking skills and a reluctance to handle and prepare meals from raw ingredients. We certainly feel these are barriers to consumption but are not so sure that they are the primary barriers. In fact, we think that there is no single cause why consumption is falling, but rather a complex mix of reasons. However, this report seems to confirm the view that health is not a key driver for growing demand of fish and seafood.

Price, price, price: Euromonitor International suggest that higher prices may be one reason why demand for fish and seafood is falling. This is certainly true now, but demand was also in decline when fish prices were much lower. ILAKS report that the Swedish Bank SEB are hoping to see salmon prices starting to fall in European retail stores next year. They say that the price to the farmer has been falling for the last six months but as yet, it has not translated into low prices for consumers. Consequently, keeping prices stable in stores has dampened consumer demand and this will only be reversed when prices come down. SEB hope that increased salmon availability, combined with lower prices will stimulate market demand.

The spot market price changes every week and depends on how much salmon is available. This uncertainty is something retailers don’t like, preferring to know what they will pay over a longer period of time. This is why contracts are so appealing. They want consumers to know the price week in week out which is why prices do remain stable in retailers for long periods of time. This was certainly the case when prices rose. Retailers held off for months before putting their prices up. Now that prices are coming down, it may be sometime before lower prices appear in store. The stores want to be sure that prices remain low for a sustained period before making any adjustments.

Of course, this does not stop retailers promoting certain product lines to try to stimulate sales. In the UK, this is certainly what is happening right now with salmon deals to be had across the sector. Currently, whole Norwegian salmon can be bought for just NOK 61/kg, whilst spot prices are just under NOK 50/kg. There are other deals to be had on fillets and we expect to see many more in the run up to Christmas.