Earned: We recently discussed how the River Earn has been downgraded to Category 3 after stocks of salmon had been described as dire. The Courier newspaper reported that a local angler had complained that hardly any fish had been caught from the River Earn this year and consequently the Scottish Government had done a U-turn on the river’s classification meaning that no fish can be killed in the coming year. The local angling club are concerned that members will stop fishing if they can no longer take one home for the pot. However, they also recognise the poor state of the salmon stock. The local fisheries’ director pointed out that it is not the classification of the river that is the problem but the lack of fish returning to the river from the sea.

Having written about the poor state of the fishing in the River Earn, we were interested to be sent a copy of the brochure for Salmon & Trout Conservation’s Annual Dinner and Auction which took place at Fishmongers’ Hall in London on Thursday 10th October. In total they raised £105,000 which will be used to ‘campaign tirelessly, effectively and forcefully, to protect wild salmon and sea trout and the wild watery ecosystems they rely on’.

Given the state of the fishing in the River Earn, we were rather surprised to see that Lot 24S of the fund-raising auction was listed a ‘Three days for three rods salmon or sea trout fishing on the River Earn.’

The lot is described as follows: ‘Big runs of fresh fish enter the Tay and the River Earn in the late summer and autumn. Most fish are grilse of around 6-10lbs or salmon of between 15-20lbs with the prospect of fish up to 30lbs. Unlike the spring and summer runs, these fish are going to spawn in the highland tributaries but accumulate in the main stem of the Tay and its lower tributaries like the Earn, offering excellent fishing opportunities. The biggest catches of the season are often taken at this time. More and more chrome-bright fresh-run fish have been caught in recent years right up to the end of the season and, indeed continue running after it.’

Guide price £1170.00

We wonder why the bulk of the auction lots feature hunting, shooting and fishing. After all, Salmon & Trout Conservation claim to be a conservation organisation. Why not raise money like other conservation groups and have a sponsored litter pick or a sponsored riverbank planting etc.? Why does raising money involve harming animals, especially the species they are trying to protect.

So according to Salmon & Trout Conservation’s brochure, more and more fresh-run fish have been caught in recent years, yet the local angling club appear to disagree as they acknowledge stocks to be in a dire state. This is also recognised by the Scottish Government in their new classification of the river. Salmon & Trout Conservation appear completely out of touch with the realities of what is happening to salmon stocks in Scottish rivers today. This isn’t that surprising given their total focus is on trying to blame salmon farming for all the ills of the wild fish sectors.

This week, S&TC featured in yet another article in the Ferret paper criticising the salmon farming industry. The paper states that S&TC, a wild fish campaign group urged as much openness as possible regarding environmental Freedom of Information requests. Their solicitor Guy Linley Adams said that it is entirely right and proper that the Scottish Government publishes as much information about the problems of the fish farming industry as it can.

We, at Callander McDowell would argue that the same should also be true of the wild fish sector. This is because S&TC say that the salmon farming industry is negatively impacting the wild fish sector yet information about the state of wild fish stocks is extremely hard to come by in real time. For example, fish catches in January 2019 will not be officially reported until well into 2020. This seems to be a major deficiency, yet the wild sector appears not to think this to be an issue.

Regular readers of reLAKSation, will know that we have collated all the catch data for all 109 fishery districts, but the data from the River Earn is included in that from the Tay District and thus is not separately identifiable. We, at Callander McDowell wonder why the wild fish sector are so vocal that as much information as possible is published about the salmon farming industry, yet even today, only minimal information is published about the wild fish sector? We hear constantly about the dire state of wild fish catches in Scotland yet there is only limited information available on which to judge what is exactly happening to wild fish.

We have asked the Scottish Government for more specific catch data from the River Earn and it seems that this has only been recorded separately since 2011 some fifty years after collection of catch data was first organised and it is still not published in the main statistics.

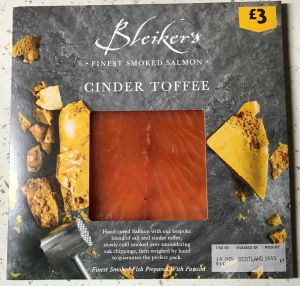

A graphical display of catches from the River Earn is incorporated into the data for justification of the new conservation classification of the river. Although specific numbers are not given, catches of wild fish from the River Earn are clearly in decline.

The question is whether downgrading the River to a Category Three river will be enough to halt the decline. Back in 1993, the former head of the Pitlochry Fisheries Laboratory, Dr Richard Shelton, told a conference on the state of wild fish stocks, that in his view,

If any fishery is in a state of collapse, then the fishery should be closed to fishing.

Perhaps this is the only viable solution to safeguard the future of wild fish in Scotland.

Market knowledge: Anti-salmon farm critic Corin Smith has come across a Market Insight Factsheet from Seafish from which he has concluded that whilst farmed salmon remains a hugely popular dish in the UK, new research shows sales have fallen 11% in two years. Mr Smith says that doubts over sustainability, relative health benefits and cost seem to be the main reason for falling sales.

Mr Smith’s comments clearly illustrate that just because critics obtain data about the salmon farming industry, it doesn’t mean that they either understand it or explain it. This is exactly the case with Mr Smith and this market data.

Firstly, Mr Smith says that this data is new research whereas in fact this specific report only runs up to June 2018. It is long out of date but despite this, Mr Smith’s comments still are not relevant. This is apparent from the table that Mr Smith has extracted from the report and posted on his website. The entry for salmon states Total Salmon, unlike the other entries which simply state the species name only. The table shows a percent change from 2017 to 2018 of value of 3.6% and minus 8.5% for volume. Over the two years 2016 to 2018, the volume fall is 11.2% as Mr Smith rightly points out. However, this is for total salmon not farmed salmon, as Mr Smith asserts.

In fact, total salmon includes Atlantic and Pacific species, both farmed and wild. So, until recently, even wild Atlantic salmon from Scottish rivers was included in the data.

The latest data for farmed salmon shows that for the last year, value has declined by 0.7% but volume has increased by 0.9%. This is an increase not a decline as Mr Smith asserts. By comparison, the volume of wild salmon sold has declined by 7.9%. Other interesting aspects of the data show a 18.7% decline in canned salmon and a 13% decline in frozen salmon.

It is also worth considering that most species have also seen a decline in volume sales. Only five of the top twenty-five species are showing some growth. The remainder have lost sales. This is in line with a general downward trend in fish consumption.

Mr Smith says that the reason why sales of salmon are in decline is because of concerns of sustainability. This is just nonsense and only occurs in the minds of critics like Mr Smith. If sustainability was an issue, then MSC certification would surely boost sales of wild Pacific species, but the data tells a different story. We won’t repeat for the umpteenth time the flaws in Mr Smith’s arguments about the sustainability of farmed salmon.

Mr Smith also says that there are concerns about the health benefits of farmed salmon but the only references to this come from known opponents of salmon farming, initially encouraged by funding from US charitable foundations, as referred to in our previous issue of reLAKSation. Frankly, the ‘concerns’ are that Mr Smith doesn’t like salmon farming and finds anyway to try to undermine it. Fortunately, most consumers see through the pretence that the only reason the wild fish lobby, which includes Mr Smith and his fish guiding business, want to save wild fish is so they can catch and kill them for their sport.

Anti-salmon farming critics try to give the impression that they know what they are talking about, when as these comments about the state of the salmon market shows, they really don’t have a clue.

Fish Tales 2: In the last issue of reLAKSation, we discussed the ‘Fish Tales’ brand following it being featured in the Keynote address at the recent Seafood Summit. We posed the question whether their Albacore tuna was worth the extra cost in Sainsburys stores over the supermarkets own Taste the Difference Albacore tuna. We suggested that the products were almost identical in terms of their sustainable credentials which was the feature of the Fish Tales brand and that maybe the extra £8kg was supporting the brand name only.

We, at Callander McDowell, have to admit an error.

We suggested that the price difference was £8kg with the multipack of Fish Tales tuna costing £26.80/kg and the Sainsbury’s own label can costing £18.80/kg. In fact, both these prices are incorrect. We have to admit that we took the prices quoted on the Sainsbury’s website at face value, but they are wrong. The correct price of the Fish Tales tuna is £18.75/kg whereas the Sainsbury’s TTD tuna costs £14.06/kg, a difference between the two of £4.69/kg, which is less than we suggested.

Ultimately, the decision of which Albacore tuna to buy rests on whether the shopper wants a multipack of 3x80g cans or a single can of 160g.

Amazonian salmon: Salmon Business report that Amazon has revealed the top trends and products that they think will dominate the food industry next year. Amongst the trends they hope consumers will buy include West African cuisine, non-alcoholic drinks and macadamia butter. For children, they believe that salmon will be on the menu. The list of trends was compiled by more than fifty Whole Foods employees with decades of experience between them.

Whole Foods believes that brands are rethinking food for kids as more millennials have children and many parents are introducing their children to more adventurous foods. They say that they are getting great results. They say they are now bridging the gap from old school basic kid’s meals and taking more sophisticated younger palates into consideration. They suggest products like non-breaded salmon fish sticks, foods that are spiced, fermented or rich in umami flavours. Coloured pasta in fun shapes made with alternative flavours. Whole Foods also say that maybe it’s time that adults start taking cues from the kid’s menu.

Whole Foods are betting that ‘Happy Fish’ fish shaped frozen salmon patties will be a big player. These are made from just salmon, salt and pepper. These can be fried, baked, grilled and even boiled – added to boiling pasta. The 200g (approx.) pack sells for between £3.99 and £4.75 depending on the outlet.

The big question is whether making salmon into a shape, without any other additives, will be sufficient to persuade kids to eat fish, especially those kids who rarely or never eat fish at all. We are not so sure. There have been several attempts to make fish friendly kid’s products and they never seem to do well over time. Many years ago, we, at Callander McDowell, argued that salmon fish fingers would be a way to entice kids and we even had some made to support our view. Later, Young’s brought a salmon fish finger to market, but it didn’t survive in the longer term.

We think that the problem isn’t the kids but rather the parents. The general decline in fish consumption is because of a loss of connection with fish. If the parents don’t relate to fish, then they won’t even look at the fish products in the store. We need to change the whole culture for fish consumption rather than just change the shape of the fish. Changing retail experiences such as buying through Amazon online will make these challenges even more difficult.

Smoking Halloween: This Halloween, Morrison’s stores are stocking a new flavour of smoked salmon from the independent smoker Bleikers. The flavour, which might be considered unusual, is Cinder Toffee. This is described as hand cured salmon with a bespoke blend of salt and cinder toffee, slowly cold smoked over smouldering oak chippings. The 100g pack is priced at £3.

The smoked salmon was very pleasant to eat but whether the cinder toffee flavour comes through is debatable. This is not surprising given that the cinder toffee amounts to 2% of the ingredients. There is perhaps a hint of smoky sweetness as an aftertaste, but without knowing that it is cinder toffee flavoured, it would be very difficult to guess the flavour. Having said that, this was a very nice smoked salmon.